If you have investment losses due the actions of William King of Merrill Lynch, contact the investment loss attorneys at KlaymanToskes today at +1 (888) 997-9956 or request a free case evaluation to determine if you are eligible for recovery.

National investment loss lawyers KlaymanToskes is investigating William (Bill) King of Merrill Lynch (CRD# 1432593), a leading broker of Merrill Lynch’s King Conley Group, who has resigned following pending allegations of unsuitable options trading and unauthorized transactions.

According to FINRA BrokerCheck, King is currently facing 21 customer complaints and was registered with Merrill Lynch in Vero Beach, FL from 1985 to April 2023, when he resigned due to “allegations of unsuitable and unauthorized trading in certain clients’ accounts”.

Investors that suffered losses with William (Bill) King of Merrill Lynch are encouraged to contact attorney Lawrence L. Klayman, Esq., at 888-997-9956 or by email at lawrence@klaymantoskes.com to discuss recovery options. We do not collect attorney’s fees unless we are able to obtain a financial recovery for you.

William (Bill) King of Merrill Lynch (CRD# 1432593) is a leading advisor broker formerly employed at Merrill Lynch’s King Conley Group. He has resigned following pending allegations of unsuitable options trading and unauthorized transactions which may have caused investor investment losses for his clients.

July 24, 2023 – KlaymanToskes announces the filing of a FINRA arbitration claim (Case No. 23-02047) against Merrill Lynch on the behalf of a customer of William (Bill) Worthen King, who seeks to recover $4 million in connection with King’s unauthorized trading, misrepresentations and unsuitable investments.

According to the claim, William (Bill) King engaged in an unauthorized, aggressive strategy of selling put options which caused the customer to lose millions. King falsely stated that the customer had 20 years of experience in options and desired “Speculation” as an investment objective. The customer had never traded options prior to Merrill Lynch and did not want to speculate with his retirement savings.

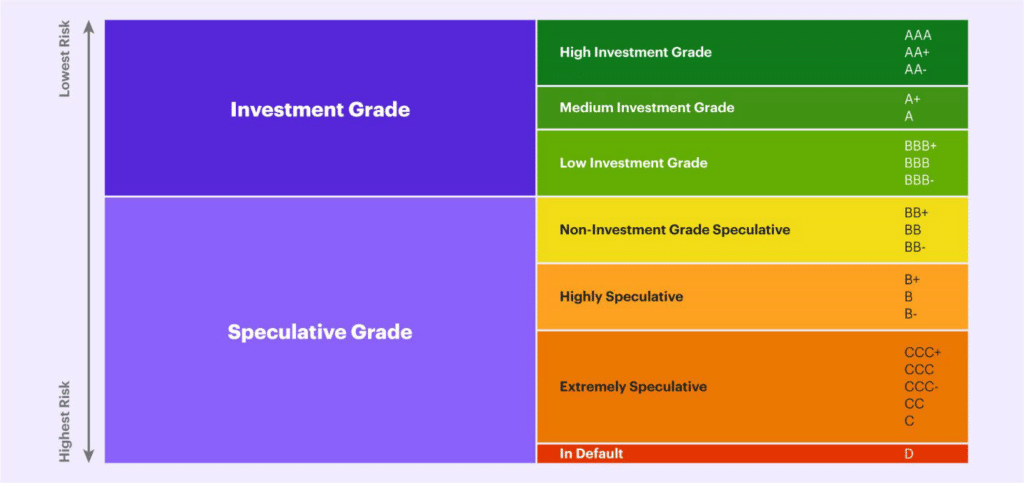

King further made material misrepresentations to the customer in soliciting the purchase of Nuveen, a leveraged, closed-end bond fund. King failed to disclose to the investor that Nuveen Quality Municipal fund (“NAD”) may invest up to 35% of its managed assets in municipal securities rated at the time of investment BBB and below. BBB is just one notch above junk bonds:

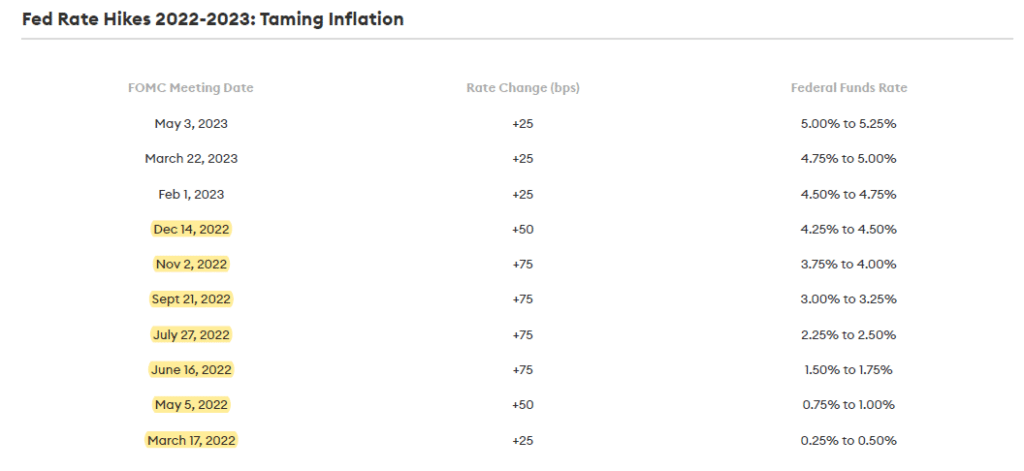

In 2022, the Federal Reserve began raising interest rates:

With the rise of interest rates, this impacted bonds which had longer durations. The Nuveen funds which contained bonds declined further due to the leverage in the funds.

In 2022, as a result of King’s unauthorized and unsuitable trading, the customer’s portfolio had losses of over $4 million.

On April 21, 2023, Bill King was permitted to resign after allegations of unsuitable and unauthorized trading in clients’ accounts. The trading involved options trading. Additionally, King, according to his Central Registration of Depository, has 21 customer complaints many of which involve the same allegations of KlaymanToskes’ recently filed claim.

King’s resignation follows his distinguished career as an “International Wealth Advisor” servicing companies, non-profits, and affluent families throughout the country. Bill King started with Merrill Lynch in November of 1985 and created a Merrill Lynch Wealth Management team called the “King Conley Group.” The King Conley Group consisted of Bill King, Kyle Conley, Rossanna Hayek, Alet Filmalter, Betty Yue, Chandler Lusardi and Christine Ruggiero.

The group started out in New York and then opened additional offices at the Merrill Lynch Vero Beach branch office. The King Conley Group was recognized as one of the top wealth management teams on the Forbes List and Barron’s with over $1.4 billion in assets under management. King touted in the media that his groups success was the result of “tailor-made strategies, precisely executed within a partnership environment.”

If you suffered losses in your Merrill Lynch account, contact KlaymanToskes for a free, no obligation account review. Our experienced attorneys can help you determine if you losses were due to similar conduct.

KlaymanToskes is a leading national investment loss law firm that represents the interests of investors throughout the world who have suffered losses due to broker misconduct, investment fraud, and securities violations.

The articles linked below contain important information relating to KlaymanToskes’ investigations of William (Bill) King:

If you suffered losses with William (Bill) King of Merrill Lynch contact KlaymanToskes at 888-997-9956 or fill out a short contact form for a free and confidential consultation.

The firm has helped recover over $600 million* for investors, and can help you determine if your loss is due to financial advisor misconduct, unsuitable investment advice, and/or other securities violations.

*Exclusive of attorneys fees and costs.

As an investor, there are a few signs that you should look out for if you believe you may have a claim against William (Bill) King. These signs could potentially indicate misconduct, negligence, or investment fraud. Investors are encourage to contact our firm immediately if you have experienced any of the following:

Some investors have close relationships with their brokers due to the time and trust built over the course of their investment relationship. However, it is crucial to remember that financial decisions should be based on careful analysis and due diligence rather than solely relying on personal relationships.

Engaging the services of an experienced securities attorney to evaluate your specific circumstances is strongly advised. At KlaymanToskes, our team of experienced attorneys has a deep understanding of this complex area of law, allowing us to provide invaluable insight and tailored guidance that directly addresses your individual needs.

If you suffered losses with William Worthen (Bill) King, or have concerns regarding your investment portfolio at Merrill Lynch, contact KlaymanToskes at 888-997-9956 or fill out a short contact form for a free and confidential consultation.